All about Statement of Financial Accounting Concepts

Oct 04, 2023 By Susan Kelly

The FASB put out a document called the SFAC that talked about big ideas in financial reporting. Generally Recognized Accounting Principles are the standards and principles for accounting that are established by FASB. The SFAC paper is intended to serve as a high-level introduction to many accounting-related principles, terms, and concepts. It's a precursor of SFAS. The FASB Accounting Principles Formalization, which went into force after October 2009, has replaced both SFAC and SFAS. Current means of updating this codification include Financial Accounting Standards Board (FASB) Concept Statements & Accounting Standards Updates (ASUs).

Knowing Statement of Financial Accounting Concepts

Accounting standard formulation is a lengthy process that begins with study, public sessions, plus public feedback and concludes with the publication of a revised accounting standard that forms part of GAAP. The SFAC is a key component of this approach because it serves as a model for how reporting policies and processes should evolve in the future. There has been a growing demand in recent years to converge accounting practices throughout the globe. The Global Accounting Standards Board is the global analogue of the United States Financial Accounting Standards Board (FASB). In nations where these standards are mandated, the IASB plays an essential role in their creation (IFRS).

At first, FASB and IASB planned to collaborate on creating a single, globally applicable set of standards. However, this strategy ran into pushback, and a compromise was reached that stipulated that the FASB would continue to establish standards in the United States while also endorsing the IFRS rules and recommendations issued by the International Accounting Standards Board (IASB).

Financial Statement Preparation Using Accounting Concepts

Financial accountants are required to follow generally accepted accounting standards (GAAP) while keeping financial records and preparing financial accounts. The principles of accruals, balancing, prudence, going concern, and uniformity will all be introduced and examined.

Money Measurement Concept

In general, only things that can be quantified monetarily are included in an accounting system's purview. Since it may be used to convey a broad range of resources possessed by a company, money is a handy common denominator. Not all intangible assets can be assigned a dollar value. Thus they won't show up on a balance sheet. Due to the constraints imposed by the monetary measurement concept, the breadth of accounting reports is necessarily constrained.

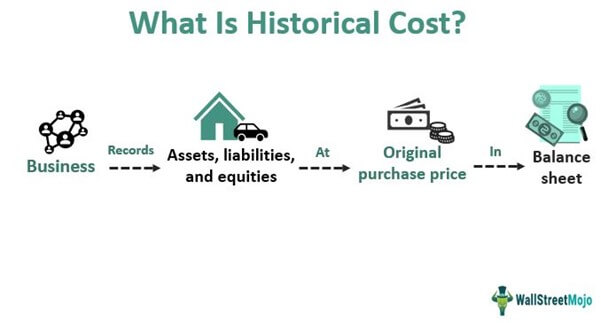

Historic Cost Concept

On the total, assets are recorded at a price that is calculated from their original purchase price (called acquisition cost). Accountants now use this valuation approach for assets rather than ones based on their market worth. This specific conjecture is contested by several analysts who point out that using unreliable metrics like prior costs to evaluate the company's present financial health is foolish. Many people believe that if assets were recorded at their current value, decision-makers would have a more accurate picture of the company's financial health. Nonetheless, there are a few issues that might arise from using current values as a measuring standard.

Going Concern Concept

To be considered a "going concern" means that a company has the resources and plans to remain operational indefinitely. To rephrase, liquidating the company's holdings is neither planned nor necessary at this time. When a company is having money problems and wants to pay off its debts, a sale like this may become necessary. This practice is significant since fixed asset sale prices are often lower than their reported values, and if the assets are expected to be sold off, projected sale deficits should be properly documented. The book value of fixed assets may be maintained if there is no plan to liquidate the assets in the near future (that is, relying on historical cost). As a result, under typical conditions, this idea bolsters the historic cost notion.

Business Entity Concept

The company and its owners (shareholders) are considered quite differently while doing the books. This is why business owners are considered creditors with regard to their stake in the company. There has to be a clear delineation in the law between the enterprises and their owners & the corporate entity idea. The legislation makes no difference between the company and its owner for sole proprietorships and partnerships (s). However, under the law, limited liability firms are considered to be separate entities from their shareholders. These legal differences are meaningless for accounting purposes since the business entity norm covers all companies.

Dual Aspect Concept

There are two sides to any deal that both have an impact on the books. Buying a vehicle with cash raises the value of one asset (the automobile) and lowers the value of another (the cash) (cash). When a loan is repaid, both the loan debt and the cash or bank balance are reduced.

Statement of Financial Accounting Standards

Similar to one another, Statements of Financial Accounting Standards (SFASs) were written to improve the reliability and clarity of financial reporting by addressing particular accounting difficulties. Before a new SFAS was produced to reflect recent best practices, there would typically be extensive public engagement regarding the possible effects of a rule change.

GAAP are a set of rules established by the Financial Accounting Standards Board (FASB) that are used to compile financial statements for public companies and are considered effective by the Securities & Exchange Commission (SEC), which oversees the American stock market.

Dec 26, 2023 Susan Kelly

Feb 18, 2024 Triston Martin

Jan 24, 2024 Susan Kelly

Oct 18, 2023 Susan Kelly

Feb 28, 2024 Susan Kelly

Oct 18, 2024 Elva Flynn