The Power of Synthetic Forwards: Definition, Functionality, and a Practical Example

Nov 18, 2024 By Georgia Vincent

This, of course, brings flexibility into the game, something important to the world of finance concerning the management of risk. And exactly where synthetic forward contracts enter the fray, imagine needing to be on the benefits of a traditional forward contract but sidestep its rigidity along with all the counterparty risks attached to it.

Synthetic forward contracts allow investors to produce like financial outcomes by using an options combination instead of having a direct agreement and add flexibility and the optionality of tailoring risk exposures to specific needs. Below, we'll break down the structure, usage, and an example of how a synthetic forward contract works.

What is a Synthetic Forward Contract?

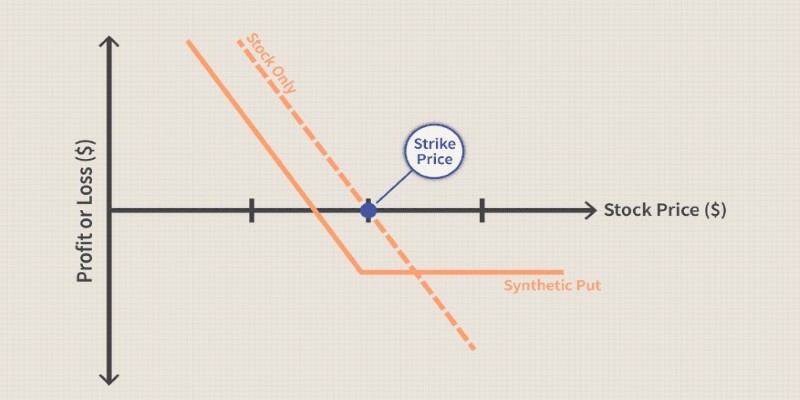

A synthetic forward contract is actually a derivative instrument created for the purpose of replicating the payoff of a conventional forward contract. It is usually implemented via options rather than a legally binding agreement between two parties. Using call-and-pull options with the same strike prices and expiration dates will allow investors to replicate essentially the same payoff of a forward contract on an asset. For instance, by purchasing a call and selling a put option on the same underlying stock at the same strike price, the investor gets, upon expiration, a cost of purchase equivalent to a forward contract.

Compared with traditional forwards, synthetic forwards are more flexible and better suited for managing counterparty risks as they can be customized. However, under a standard forward contract, an investor commits to liability or obligation to buy/sell at an agreed-upon future price.

How do Synthetic Forward Contracts Work?

The mechanics of a synthetic forward are based on two legs: a long call option--the right to buy with the same strike price as the short put option as well as the same expiry date--and a short put option--the obligation to sell. Here is how this structure generates a forward-like result:

Establishing the Contract:

An investor buys a call option and simultaneously sells another put option with equal strike prices and expiration dates. This structure means the investor will purchase the underlying asset at the strike price at expiration, regardless of changes in the market.

Outcome at Maturity:

In a call option, the investor exercises it when the market value exceeds the strike price. Here, the investor buys at the low predetermined strike. The put option, on the other hand, forces the investor to buy it when its market value is less than the predetermined strike price; hence, it mirrors exactly the payoff of the forward contract.

Balancing Risk and Cost:

This contract "locks in" the investor's future price for the asset without committing to a formal forward contract. However, it also carries a net premium cost on options depending on the market conditions and strike price of the options utilized.

Synthetic forward contracts are also commonly used for hedging purposes, especially when direct forward contracts are not available or when a party wishes to retain some elements of flexibility. Commodity market investors, foreign exchange, and stock investors use synthetic forwards to hedge against price change while reducing their exposure to market risk.

Example of Synthetic Forward Contract

For instance, consider the following example:

Suppose a manufacturing firm expects copper, an important raw material, to rise in price in six months. They do not want to contract directly; instead, they opt for a synthetic forward. They structure it in the following way:

Stage 1: The company purchases a call option on copper for $100 a unit for six months.

Step 2: To save this cost, they sold a put option on copper with the same strike price and maturity date.

Outcome at Expiration:

Price Up: During maturity, if the price for copper is more than $100, the company exercises a call option, and the firm purchases copper at that price even after the market price goes high so that it achieves the supply at a given competitive price.

Price Decrease: When the price declines to $100, the put option will be exercised, binding the firm to buy copper at $100 like any traditional forward contract.

With this synthetic structure in place, the company realizes protection similar to that a forward contract affords, which guards it against price raises without entering a binding forward contract. They also mitigate some of the disadvantages often linked with forward markets, especially liquidity or market-maker barriers.

Advantages and Considerations of Synthetic Forward Contract

Heres a look at the key advantages and considerations associated with synthetic forward contracts:

Advantages of Synthetic Forward Contract

Customization and Flexibility: Investors can influence certain aspects of the contract, such as adjusting premium costs by using strike prices or expiration dates.

Risk Management: They are instruments used to hedge against the price volatility of the underlying asset without the risks from the counterparty, usually linked with traditional forwards.

No Direct Obligations: Synthetic forwards are not like the forward contract, which always requires fulfillment. This is because synthetic forwards involve options that can be altered, exercised, or simply allowed to expire.

Considerations of Synthetic Forward Contract

However, synthetic forwards do have some drawbacks. Premiums must be paid upfront, which increases the total cost. Additionally, there can be a time during the structure's life when the value of the options could be affected by volatility, leading to a complex structure that might not always yield profits as expected. There are also requirements to select proper options so that the potential misalignment of strike prices and expiration dates does not give undesirable financial results.

Conclusion

Synthetic forward contracts offer corporations an extremely flexible, efficient form of risk management that replicates the synthetic form of the forward through the combination of options rather than outright agreements. That structure appealed to corporations and investors on commodities through to currency markets who need the stability of such a hedge on price without risking over and above other counterparty risks. Through the use of synthetics, investors have something that supports strategic risk avoidance but is not bound to the traditional forwards, which, in turn, allows them to address market fluctuations with greater zeal and control.

Feb 28, 2024 Susan Kelly

Dec 05, 2023 Susan Kelly

Dec 14, 2024 Elva Flynn

Nov 19, 2023 Susan Kelly

Oct 18, 2024 Elva Flynn

Oct 29, 2023 Triston Martin